Media Report

A New Journey of Sweetener Subdivided Oligarch: Can LeSweet Lever the New Blue Ocean of Sugar Substitutes in China?

Date:2019-07-08 Views:8999

Jinhe Industrial (002597), as the global leader in the sub-field of raw materials of sucralose, acesulfame and other sweetener, has recently promoted a new strategic product formally oriented to consumers, i.e., LeSweet Zero-calorie Sugar. Once the upgraded version of LeSweet, for which, the presale was officially launched on July 7, was promoted, it has attracted extensive attention from investment institutions, media and industries. In this promotion, can Jinhe open up a new Blue Ocean of sugar substitute market valuing RMB 100 billion?

Picture source: LeSweet JD.com Flagship Store

Why does the sweetener giant Jinhe Industrial choose to promote new products from business end to consumer end at this time node?

What kind of healthy sugar product will the new consumer-end product introduced by Jinhe Industrial be after 24 years’ development?

How will the new product affect the sugar substitute market?

After we learned the news, we immediately contacted the management of Jinhe Industrial (002597) to unveil the new strategy of the leading company of sweetener behind this mysterious new product.

01

Take advantage of the situation to seize the initiative:

2019 is a year of great sale of low-sugar and sugar-free products in the world, and sugar reduction has become an irreversible trend.

In the past, “sugar” used to be an important factor for the great sale of new food and beverage products in the packaging, but now, “sugar reduction” has become an important selling point for the giant’s success in promoting new products. Why is there such a change? The core driving factor lies in the increasing demand of consumers for health. According to the latest research data of Innova Market Insights, nearly half of the US baby boomers want to reduce their sugar intake and buy more less-sugar food, while two-fifths of the people are reducing their consumption of sweets. [1]

This also means that whoever can seize the initiative in reducing sugar is expected to have more shares in the future market.

Let’s take the beverage category as an example for corresponding analysis. The era of sugar-free beverages has come: for example, Day Day Up, a rising star in China’s beverage market in recent years, is a sugar-free beverage. Coca-Cola, the giant in beverage industry which has promoted sugar-free coke in advance since 2005, has experienced revenue decline in its traditional carbonated beverage products for many years since 2013. But its 2018 Q2 report shows that its low-sugar and sugar-free carbonated beverage products have achieved double-digit growth. Coca-Cola discovers that the consumers’ demand for sugar reduction is maturing and is becoming a new trend. Therefore, it has continued to develop more less-sugar products since 2018 and has continuously introduced nearly 10 new less-sugar products.

Picture source: Coca-Cola official website

Up to now, Coca-Cola has introduced many new low-sugar and sugar-free products, including Coke Zero Sugar, Zero Calorie Sprite, Fanta Zero, Coke Fiber+, Sprite Fiber+, Kenneth Sugar-free Tea Drink, ChunYue Fiber Water, Cucumber-flavored Sprite Fiber+, Sprite Coconut, COSTA Low-sugar Instant Coffee, Yiquan +c Less-sugar Version, Meizhiyuan Light Everyday and other low-sugar products. It’s worth noting that Q1 financial report of Coca-Cola in 2019 shows that its zero-sugar beverages have achieved double-digit growth for the 6th consecutive quarter.

This trend has also swept the beverages in offline catering market. In 2018, as the first company promoting less-sugar substitute syrup in China, Heytea also enjoyed the benefits. According to the disclosure of industry insider, in the first few months after the product was promoted, due to the consumers’ limited awareness of sugar substitute syrup, only a few consumers chose low-calorie and low-sugar syrup, accounting for only 1/10. However, in a few short months, the data suddenly broke out. With the improvement of consumers’ awareness, the consumption of sugar substitute syrup of Heytea in 2018 unexpectedly reached 1,000 tons, which was astonishing.

Picture source: official WeChat public number of Heytea

Due to the limited length of the article, the analysis will not be carried out one by one. In short, the less-sugar and sugar-free trend is spreading not only in beverages, but also in dairy products, snacks, baking, wine, instant noodles and other subdivided categories of food industry. As a supplier of sugar-free and low-sugar solutions and sweetener products for the giants, Jinhe Industrial has also made great profits.

According to 36Kr’s previous reports, Jinhe Industrial not only provides sugar-free sweet raw materials for many food and beverage giants such as Coca-Cola, Nestle, Danone, Mengniu, Yili, etc., but also occupies 65% of the acesulfame market share in respect to global production capacity. In addition, it ranks the 2nd in the world in respect to sucralose and is in the oligopoly leading position in sweetener sub-field.

There is a saying that “the duck knows first when the river becomes warm in spring”. Exactly because Jinhe Industrial has been engaged in the production and sales of sweetener raw materials for decades and has continuously strengthened its R&D innovation ability to provide sugar reduction solutions for the market, Jinhe is especially sensitive to the changes in market demand. The company has not only developed more less-sugar and low-calorie syrup custom schemes for the business end in fresh tea drink industry to help tea drink brands promote healthy beverages that have lower calorie and lower sugar content, but do not affect the taste, but also prepared its first TO C brand—[LeSweet] since 2017.

The layout of this series can be described as taking advantage of the situation and has seized the initiative for the rise of China’s sugar substitute market. However, the questions have also arisen, for example, why does a sweetener oligarch focusing on business end have such courage to invest large sums of money, talents and technical resources to engage in consumer market that it has never done before and to extend and promote new products to the consumer end? What is the strategy behind this? We will answer these questions one by one in the following chapters.

02

Why is there still no mature consumer-end sugar substitute brand in China under the determined trend? The answer may be that no enterprise wants to be the first to eat crabs.

Recently, ADA (American Diabetes Association) announced a blacklist of beverages at its meeting in 2019. The conclusion is that sweet beverages cannot be drunk, which has aroused widespread concern and debate in the global medical field and the public. Is sugar-free sweet beverage healthy or not? Nowadays when the demand for anti-diabetes, anti-obesity and anti-saccharification is increasing, how should the consumers enjoy sweetness more healthily? For these questions, the consumers still have misunderstanding on the cognition in European and American markets which are relatively mature in the development of sugar reduction products, not to mention in China, where the development is still in its infancy.

&According to Mr. Yang Le, the chairman of Jinhe Industrial, “the more sweeteners we sell to the European and American markets, the more confused we will be: why are consumer education on sugar reduction in European and American countries done so well? How can the 1.3 billion consumers in China have the convenience and right to freely choose sugar-free products in every consumption scene in daily life? These are the questions we have been thinking about. Why can we drink Coke Zero everywhere in a small town in Europe, but there is no sugar-free beverage in many restaurants in China’s first-tier cities? Why can we only drink ordinary Coke or syrup of plum, coconut milk and other sugared beverages which contain a lot of sugar after eating hot pot and kebab? If you are a diabetic, why can you only choose mineral water or plain boiled water in order not to take in sugar? After all, life needs sweet embellishments and cannot be dull and bland all the time.”

As a young and energetic chairman of A-share, Mr. Yang Le has lived and studied in North America for several years, and often goes to Europe, America, Japan, South Korea and other countries to attend exhibitions and visit customers. Therefore, he knows the sugar reduction trend and development process in developed countries very well.

“The establishment of ‘LeSweet’ is not only a commercial consideration, but also out of corporate social responsibility. We hope to be the first person to eat crabs in Chinese market to not only sell healthy and safe less-sugar products, but also carry out consumer education on sugar reduction well, popularize popular science knowledge related to sugar substitutes and help Chinese consumers eat the sugar which has better quality and taste, nutrition and delicious taste, and is suitable for their own bodies. This is also a special action in response to the National Nutrition Plan (2017-2030) issued by the General Office of the State Council for actively promoting a healthy lifestyle for all people and focusing on ‘three reductions and three healthy (salt reduction, oil reduction and sugar reduction, and healthy oral cavity, healthy weight and healthy bones)’, so that Chinese consumers can have healthier and more nutritious sweetener choices while enjoying sweet and delicious food.” He added further.

Picture source: LeSweet JD.com Flagship Store

Through searching the e-commerce platforms such as Taobao, JD.com, etc., we discover that there are also sugar substitute products in domestic consumer end and the sales volume of some brands is also good. However, Jinhe Industrial is really willing to shoulder the responsibilities of consumer education and public science popularization, and willing to take large costs and risks to cultivate the market and become a brand of consumer education. Jinhe Industrial is a pioneer.

Behind this, it is not only because it has keenly sensed the changes in business opportunities and consumer demand, but also because it is the enterprise social responsibility shouldered by the leading enterprise in the sub-field in the world.

03

Redefine the sweetness:

Can LeSweet lever the new Blue Ocean of sugar reduction in the Chinese market?

1. Blue Ocean Gold Digging Opportunity in Red Ocean: Consumer-end Sugar Substitute Market

According to Mr. He Xiangkun, the person in charge of TO business-end services of Jinhe Industrial, the ratio of sugar substitute products to sucrose products on seasoning shelves in Europe and America is 9:1, while in China, the figure is only about 1:9. At present, obesity, diabetes, anti-saccharification, anti-caries and other health needs of Chinese people are increasing day by day. The consumer market of sugar substitute products have great potential and is a Blue Ocean opportunity that is about to erupt.

Such brands as Equal and Splenda have already exceeded USD 1.5 billion in volume in Europe and the United States, and corresponding products have been sold in more than 80 countries all over the world. China is a consumer market growing fastest in the world at present. It’s believed that in the near future, the brands such as Slenda will also appear in the Chinese market. Will more players enter this field following Jinhe? We will also follow the development of this category continuously.

Picture source: ifanr

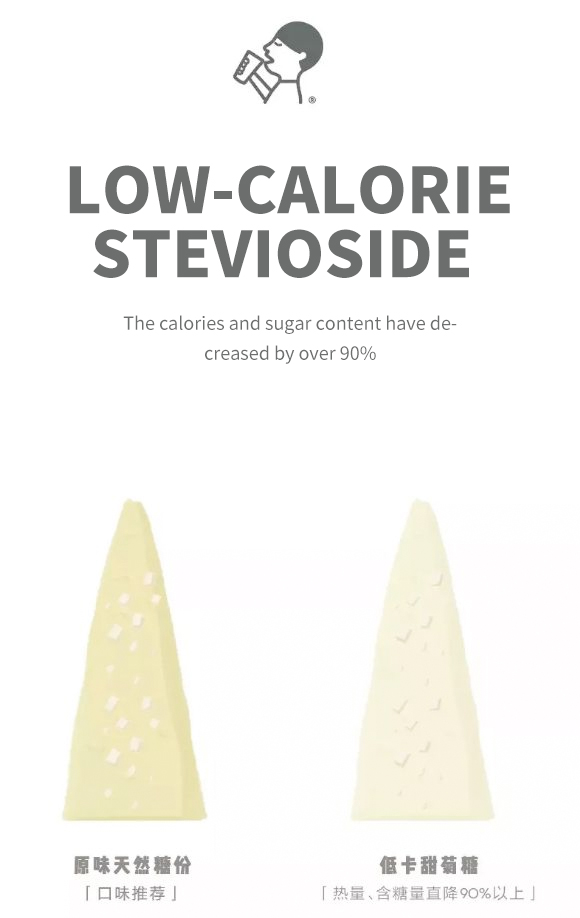

&2. Through many years’ technical sedimentation and formula tests and adjustments for more than 200 times, LeSweet 2.0 product is developed wholeheartedly

Mr. He Xiangkun introduced to us that LeSweet 2.0 had gone through formula tests and adjustments for more than 200 times by R&D team. Different from the first generation of LeSweet with the sweetness ratio of 1:7 with sucrose, the second generation of LeSweet has achieved the sweetness ratio of 1:1 with sucrose, so that the users can obtain the same sweetness without changing their habit of adding sugar and the convenience of use is improved.

Picture source: 36Kr

From the perspective of formula research and development, LeSweet has pioneered a compositional formulation of combining the new-type artificial sweeteners and natural nutritive sweeteners in China.

Through the test of formula ratio for more than 200 times, the health and nutrition have been guaranteed while the taste similar to that of sucrose is obtained. In addition, the calorie, sugar and fat are all reduced to zero in the condition that the taste is not changed, which is one of the most core pain spots of less-sugar products at present and is also the barrier.

Behind this lies the core competitiveness of Jinhe Industrial brought about by decades of technological deposition in formula technology and application R&D technology.

Picture source: LeSweet JD.com Flagship Store

In addition to high-quality new-type sweeteners such as stevioside, sucralose and erythritol, resistant dextrin, a kind of dietary fiber, has also been added to the formula of LeSweet, which has enhanced the function and nutrition of the product. According to the ten major trends in global food and beverage industry mentioned in Innova2019, the consumers are increasingly paying attention to the health of brain and intestines, which has also made the dietary fiber hot and become one of the most noteworthy trends this year.

In addition, the packaging design and specifications of LeSweet are close to the preferences of young people. There are both portable box-packed products that can be carried around and large vertical bagged products suitable for family cooking. Different from the simple and plain packaging of the sugar substitutes in the past generation, the packaging of LeSweet has strong visual impact and is more in line with the preferences of millennial face-judgers.

3. Online e-commerce presale and co-branding cooperation are making concerted efforts to analyze future market strategies

Excellent product strength building can only be said to be the first step towards the success in promoting new products, and every link of the subsequent sales and marketing strategies is crucial. What kind of market strategies will LeSweet, a supplier, adopt when it extends to the consumer market?

1) Create new media content marketing strategies for the target audience, young people consumer groups

We have noticed that LeSweet has officially entered Tmall and JD.com flagship stores since yesterday, and has launched the presale of 2.0 new products with a very high discount. Click to read the original text to participate in the presale. Meanwhile, LeSweet has also chosen various channels such as Microblog, Little Red Book, Douyin, Bilibili, etc., which are popular among young people, to touch and influence the target consumers by creating high-quality contents, so that everyone can know that there is still such a better choice of sweet taste.

2) Launch a co-branding plan and a marketing strategy of 1+1>2

According to Sam, the person in charge of LeSweet brand, LeSweet’s goal to redefine the sweetness is not to shout slogans. The promotion of a revolutionary product requires more people to experience and try before talking about like and lifestyle. Therefore, after the product strength and brand strength are strengthened, LeSweet will also launch co-branding cooperation. At present, they are not only in contact with offline brands such as cafe chain, fresh tea drink chain, hotel catering chain, etc. for cooperation to help these brands keep up with the less-sugar trend, increase the selling points that attract users and provide higher quality products and services. In addition, they are also negotiating with excellent brands that also face consumer end for cooperation. For example, LeSweet has developed a gift box set jointly with UPYIM, a high-end bird’s nest brand, so that the fairies can enjoy “anti-sugar + beauty + delicacy” in one step.

For the brands with the same target audience, whose brand strength and product strength can realize synergistic effect, LeSweet will enhance its cooperation with them in the future, so that more people can enjoy sweetness healthily.

3) Develop new offline retail and distribution channels

In the future, LeSweet will also develop offline channels and plan to enter FamilyMart. Meanwhile, it will lay out new retail channels such as freshgema.com, Meicai.cn, YH Super Species, etc., and make further channel layout plan according to the market development. The core goal is to enable the consumers to see and buy LeSweet healthy sugar more conveniently.

04

Conclusion: A New Journey of Sweetener Oligarch

In recent years, it is an important trend for the companies in TO B field extending to TO C and the companies in TO C field expanding to TO B.

The giants in traditional TO B field, for example, New Hope, Cargill, etc., are making layout to expand to the consumer end, and have achieved very good results through the experience for several years.

As a leader in food additive and ingredient industry and a leading supplier of sweeteners, Jinhe takes advantage of its technologies, supply chains, cost advantages and other barriers deposited in business market this time to launch a new generation of healthy sugar products with an in-depth insight into the users. It can be said that it has seized the opportunity of upgrading sugar substitute consumption and subverted the existing sugar substitute products in the current Chinese market.

In the future, how will it make full use of its strength and avoid its weaknesses, and can it become the first high-end sugar substitute retail brand in China? Let’s wait and see!

Reference source:

[1] Innova: Sugar Reduction Is Becoming the Consumers’ Main Diet Demand, May 23, 2019, Healthy Raw Materials Online